In the last six to ten years the mobile channel, which is used for marketing, services and content distribution, and commerce has matured dramatically and drawn much attention from a wide range of constituencies, including brands, content owners, retail and media, marketing practitioners, application developers wireless network providers, popular press, industry analysts, government regulators, consumer activists, and consumers. There are many reasons why the mobile channel is receiving so much attention. The least of which is the clear consumer demand for mobile content and services and the recognition that the mobile phone may also be a viable tool for facilitating payment for goods and services. The mobile phone is not only good for paying for content and services consumed on the phone but also for “non-digital” payment transactions (i.e. the purchasing of books, tickets, person-to-person payments, CDs, etc). The mobile phone content and data services market, such as music, gaming, and video, is forecasted to reach $43~$50 billion worldwide by 2010, up from $5.2 billion in 2004 (Sullivan & iSuppi 2006, Digital Music Report 2006), and according to analysts, non-digital transactions will be more prevalent by 2009, up from practically nothing today. With all this industry attention, however, there is little research available to help industry practitioners and academics understand the key elements that drive consumer acceptance for the most ubiquitous method of mobile payment, Billed to Phone. With the Billed to Phone method purchase transactions are billed to mobile subscribers’ phone bill and the proceeds for the transaction are split between all the parties in the value system. There are a number of academic studies that propose conceptual models for mobile commerce and look at the consumer acceptance of the mobile channel, but there are no empirical studies that evaluate consumer acceptance and use of Billed to Phone payment methods. This article provides a brief review of the Billed to Phone payment methods and addresses the need for additional academic research into consumer acceptance and effectiveness drivers of the Billed to Phone billing method.

Mobile content is sold either directly from the mobile operator’s “On-portal” storefront, which is often referred to as the “On-deck” storefront, or via third-party content service provider storefronts referred to as “Off-portal” storefronts. These Off-portal storefronts can take many forms, including Web and Mobile web site, radio, TV, live event public announcements, email, Instant Voice Response (IVR), and various forms of print matter (flyers, magazines, newspapers, etc.). Qpass reports that U.S. and European markets are quite different when it comes to Off-portal and On-portal sales demarcations. In Europe, the market has been primarily driven by third-party content service providers with roughly 70~80% of content sold Off-portal as opposed to 20%~30% On-portal. While in the United States Off-portal sales just became viable only 15 months ago and so the picture is reversed with roughly 31% of content sales Off-portal and 69% On-portal (Blanksteen 2006). Another important aspect of the billing event is the way the product is packaged and the frequency of billing, i.e. is the content or service sold via a pay-per-view, pay-per-download, or subscription model. Moreover, how the content is packaged or bundled with other services needs to be considered (note, bundling is something that is difficult to do today given the number of technology and regulatory roadblocks in the mobile landscape). Frequency of the billing period (weekly, monthly, etc.) should also be considered. These models and package programs are used by both operators and third-party providers with varying degrees of success.

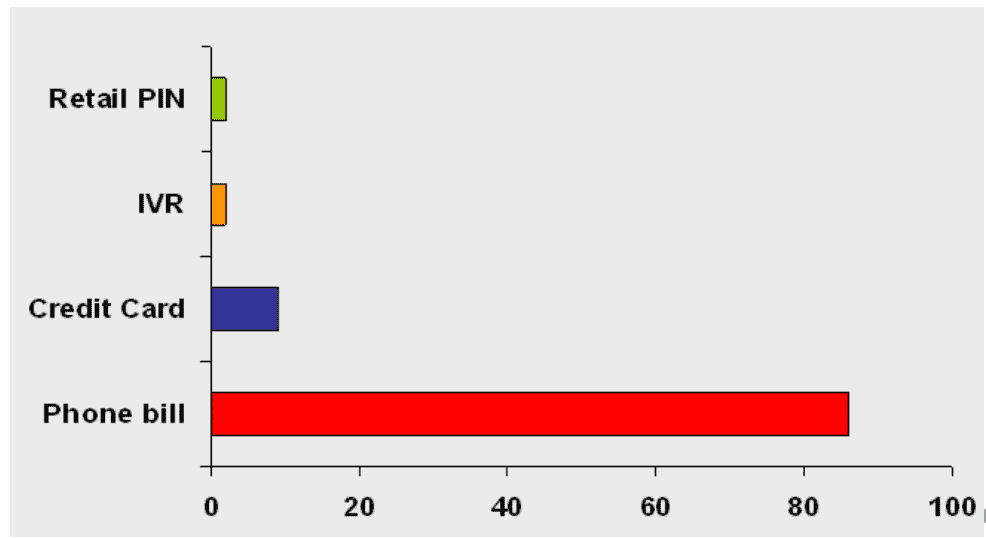

To process digital mobile content and services, and non-digital, purchase transactions a number of payment methods are applicable, such as credit card billing, Pay Pal, loyalty point, promotional or coupon code, retail pin, m-wallet, and Near Field Communication (NFC)[1] powered non-digital transaction solutions to name a few. However, these methods are quite limited in their use compared to Billed to Phone methods. Bango, a global mobile billing enabler estimates that nearly 87% of mobile content payments are Billed to Phone, with only 9% billed to credit card, and 2% billed through IVR and 2% via retail pin., see Figure 1.

The Bill to Phone payment method is employed primarily for mobile content and service micropayments, i.e. content and services with a value less than $10.00 consumed directly on the mobile phone, although there are some early trials in Europe and Asia for non-digital Billed to Phone transactions. With the Bill to Phone Payment method a consumer purchasing a good or service (from an On- or Off-portal storefront) has the charge for this good or service appended directly to their mobile phone bill once they’ve completed their transaction. Bill to Phone payment is performed either through Premium SMS or WAP billing.

Premium SMS billing refers to the use of mobile originated (MO) or mobile terminated (MT) SMS messages to initiate the charge. A mobile originated message is a message sent from the mobile phone to a content or service provider, while a mobile terminated message is a message sent from a content or service provider to the mobile phone. What distinguished a premium rate SMS message versus a standard rate message is how it is encoded by the service provider. For a standard rate message the service provider simply sends the message, however for a premium rate message the service provider encodes a price to the message, e.g. $1.99, $2.99, up to $9.99, when sending the MT message or receiving the MO message. In either case, depending on the marketing program or how the common short code and keyword is configured within the mobile operator network and service provider application, a charge can be applied to the wireless subscriber’s phone bill when the MO message is received by the service provider from the mobile subscriber or when the MT is sent from the service provider and received by the wireless customer. In the United States, only MT billing is accepted, while in Europe both MT and MO billing is possible. Regardless of the method, MO or MT, best practices and more often than not regulations, call for obtaining confirmation from the wireless subscriber before the charge for the purchase can be billed by the service provider. This confirmation process is referred to as the Double Opt-in Process and is performed in one of two ways. The first way, Premium SMS billing, confirmation is performed through the sending of an SMS message to the mobile subscriber’s phone, which must be affirmatively replied to by the mobile subscriber. Once the service provider receives the purchase confirmation the service provider sends the content download URL to the customer. When customers have successfully downloaded the content to their mobile phone, the service provider sends a MT billing SMS (often in the context of a thank you message and billing receipt) to the customer to finalize the charge. The second way Premium SMS billing confirmation is performed, and the more user friendly is with Mobile Internet pages. When customers initiate the purchase for content or service, the service provider sends a Mobile Internet link to the customer. By clicking on this link the customer is taken to a confirmation web page on their mobile phone where they are presented with a purchases confirmation buy button. Upon clicking the confirmation buy button the content begins to download and once the content has successfully been downloaded a MT billing Premium SMS message is sent by the service provider to the mobile subscriber to charge the customer for the content.

The second Bill to Phone method is the Mobile Internet Billing method, which unlike Premium SMS, does not leverage SMS messaging. Rather, purchases and confirmation of purchases all happen on the Mobile Internet site. The mobile subscribers select a piece of content, select the confirmation button, and the charge is applied to their phone bill without a Premium SMS message needing to be sent. This practice is quite common and generally available across most European networks but is only available in the United States via Cingular Wireless and T-Mobile wireless networks. Bango’s SVP Marketing, Anil Malhotra, estimates that with the Billed to Phone model 60% of U.S. content is billed through WAP Billing, while 40% is billed through Premium SMS. For the rest of the world, Malhotra estimates that 65% of Billed to Phone transactions are WAP billed and 35% premium SMS.

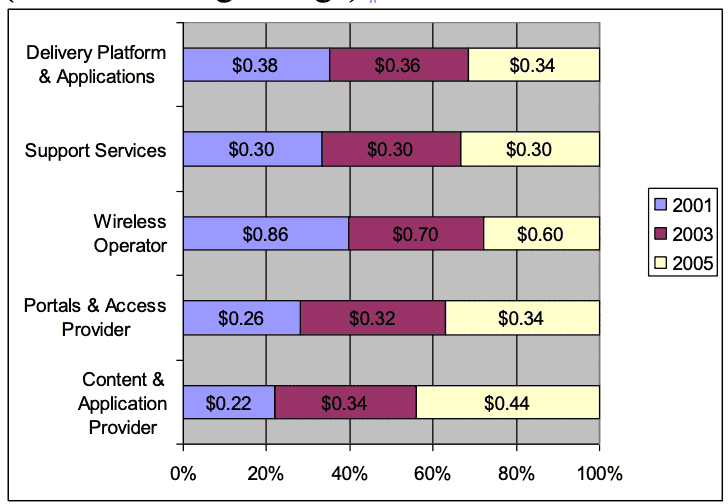

From the wireless subscriber’s point of view the Billed to Phone method is fairly straightforward, although, like any new technology, there is a learning curve. As for the players in the value system, there is a little more that needs to be understood, especially when it comes to revenue splits, which vary between the parties within the value channel. Rulke (2003) identifies five different “elements” or parties within the mobile value system that share in the revenues from mobile commerce transactions: Content & Application Provider, Portals & Access Provider, Wireless Operator, Support Services, Delivery Platform & Applications providers. Barnes (2002) provides a similar typology, Content Creation, Content Packaging, Market Making, Mobile Transport, Mobile Services & Delivery Support, Mobile Interface, and Applications. Rulke’s estimated revenue share splits are illustrated in Figure 2. Even though Rulke’s study is a little over two years old the findings seem consistent with today’s market. Qpass estimates that the wireless operators retain 35%~50% of the revenues depending on the operator and traffic volume (Blanksteen 2006), and Bango has published similar figures. As for the share of the parties other than the wireless operator, the Rulke findings also seem consistent with today’s market; although, it is important to note that branded content owners seem to be reaping a higher than average percentage of the revenues over generic content providers.

Although Billed to Phone models are evidently quite prevalent, they are not without challenges. Successful billing is not always assured, Malhotra reports that WAP billing has a 90% transaction completion rate, while Premium SMS is highly variable, with success rates between 58% - 85%, depending on the network and whether or not the subscriber is on a pre or postpaid account (i.e. with pre-paid being less successful than post-paid) (Malhotra 2006). Qpass, in a recent webcast “, Is Premium SMS a Sufficient Billing Mechanism?”, also points out challenges with premium SMS billing. Qpass notes that non-intuitive user purchasing experience, lack of uniformity in the purchasing experience across storefronts, the lack of line item billing, revenue leakage, inability to initiate chargebacks, revenue auditing, and distribution, and automated business rules can all be significant challenges when managing Premium SMS billing methods (Blanksteen 2006). To make Billed to Phone methods more effective, research is needed on how to overcome these and related challenges.

Even with all this attention just a handful of academics have studied and published research that helps explain and educate practitioners on how to best utilize this emerging medium for commerce, and none seem to focus on Billed to Phone methods. Much of the mobile commerce literature tends to be conceptual in nature or it empirically evaluates methods other than Bill to Phone, which as shown above are the most viable billing methods today. Much of the mobile commerce literature tends to look to the Internet e-commerce literature for guidance, or it employs the value system or value chain analysis as a lens to develop conceptual models and theories to understand mobile commerce. Perhaps the theory often used in mobile marketing literature may be applicable to understand Billed to Phone mobile commerce, such as Fishbein and Ajzen’s Theory of Reasoned Action, Optimal Stimulation Theory, Roger’s Innovation Diffusion Theory, Theory of Cognitive Dissonance, Technology Acceptance Models, Uses and Gratification Theory, and Theory of Perceived Risk (Wu & Wang 2004; Bauer et al, 2005; Tsang et al 2004; Okazaki 2004), may help ground future studies. But this has yet to be seen.

Mobile commerce and usage of mobile for marketing activities is incredibly complex, and little is understood or has been proven about how it really works or what influences consumer response and acceptance to use the medium. As discussed, the market for mobile content and services is growing rapidly, as is the use of the mobile channel for processing and billing for both goods and services consumed on the mobile phone and non-digital content products, and services. There are still many unanswered questions. What is needed are specific empirical studies backed by theory in order to develop applicable generalization that can be used by industry practitioners to develop and refine their services. In particular, Bill to Phone services academic research is needed.

References

Barnes, S. (2002). The mobile commerce value chain: Analysis and future developments. International Journal of Information Management, 22, 91~108.

Bauer, H. H., Barnes, S. J., Reichardt, T. and Neumann M. M. (2005): Driving consumer acceptance of mobile marketing: A theoretical framework and empirical study. Journal of Electronic Commerce Research, Vol. 6, No. 3, pp. 181-192.

Blanksteen, S. (2006, 23/Feb.). Is Premium SMS a Sufficient Billing Mechanism? In Qpass Webcast. Seattle, WA: Qpass.

Digital Music Report. (2006, January). London: IFPI.

Malhotra, A. (2006, 8/March). Email Interview.

McKitterrick, D., & Dowling, J. (2003, September). State of the Art Review of Mobile Payment Technology., Department of Computer Science, Trinity College Dublin.

Mobile Messaging Futures 2005-2010. (2005, 27/June). Retrieved 3/6/06, from Portio Research: http://www.portioresearch.com/MMF05-10.html.

Okazaki, S. (2004). How do Japanese consumers perceive wireless ads? A multivariate analysis. International Journal of Advertising, 23.

Rulke, A., Iyer, A., & Chiasson, G. (2003). The Ecology of Mobile Commerce: Charting a Course for Success Using Value Chain Analysis. In B. Mennecke & T. Strader (Eds.), Mobile commerce Technology, Theory, and Applications (p. 122~144). Hershey, PA: Idea Group Publishing.

Sullivan, L. (2006, 8/March). Mobile Music, Gaming, Video To Reach $40 Billion By 2010. Retrieved 3/9/06, from http://www.informationweek.com/news/showArticle.jhtml?articleID=181502079&subSection=Columns.

Tsang, M. M., Ho, S, & Liang, T. (2004). Consumer Attitudes Toward Mobile Advertising: An Empirical Study. International Journal of Electronic Commerce, 8(3), 65-78.

White, J. (2006, 2/24). Email. Portio Research.

Wu, J.-H., & Wang, S.-C. (2004, 24/July). What drives

mobile commerce? An empirical evaluation

of the revised technology acceptance model. Information & Management, 42.

[1] Near Field Communications (NFC) is a passive communication technology developed by Sony and Phillips being developed for a wide range of services, including point-of-sales commerce services. See http://en.wikipedia.org/wiki/Near_Field_Communication for additional detail on NFC.

Credits: Image by mohamed Hassan from Pixabay

No Comments.